Australian employment law has gone through substantial change over the last 12-months following amendments to the Fair Work Act. Many believe that the government’s latest proposal, the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023, is the most significant change to Australian workplace and industrial relations since the Fair Work Act commenced in 2009.

The Bill will not be put to a vote until early 2024. However, employers should be mindful of what is being proposed and how they will be affected should the Bill be passed in its current form.

Here is a summary of some of the key changes proposed:

- Casual conversion and casual employee definition: amending (again!) the definition of casual employee to look at the practical reality of the relationship as a whole. Casuals would gain a right to request conversion every six months. The Fair Work Commission (FWC) would also have the power to arbitrate disputes about conversion.

- Contractor vs employee: the meaning of employer and employee will be subject to an interpretive principle focusing on the ‘real substance, practical reality and true nature of the relationship’ rather than the written contract in place. This change is likely to increase uncertainty about the distinction as it winds back.

- Same job, same pay for labour hire workers: the FWC would be empowered to make regulated labour hire orders. These would require labour hire workers to be paid no less than if the employees were working for the host employer.

- Regulation of ‘employee-like’ workers: the Bill proposes extensive new regulation for workers in the gig economy and road transport industry. The Bill contains a regime for the FWC to set minimum standards and hear arbitrate disputes.

- Increased protections and rights for union delegates: introduces new general protections alongside further rights for workplace delegates to access the workplace and facilities – in some cases without notice – and for reasonable communication with members. Further, employers will be required to allow workplace delegates paid time to attend training, and reasonable time and facilities at the workplace to communicate with employees who are current or prospective union members.

- Sham contracting: restricts the defence available to employers who misrepresent employment as an independent contracting arrangement.

- Wage theft: introduces a new criminal offence for wage theft that targets intentional underpayment of employees. Related offences could implicate employees, officers and agents of employers. There are provisions for self-reporting to the Fair Work Ombudsman (FWO) and for “Cooperation Agreements” between the employer and the FWO so that the employer’s conduct may not be referred to the .

- Increases to civil penalties: increases maximum civil penalties relating to underpayments or employee entitlements and amends the meaning of a ‘serious contravention’. Penalties have increased at least five times and sometimes ten times the current penalties for contraventions of the Act.

- WHS amendments: including the introduction of industrial manslaughter provisions, increasing maximum penalties. The proposed amendments also focus on silica related diseases and provide easier access to workers compensation for first responders suffering from PTSD.

- Discrimination protections – family and domestic violence: proposes stronger discrimination protections against adverse action for employees who are subjected to family and domestic violence.

- Small business redundancy exemption: the small business exemption will be amended to capture large businesses who would otherwise qualify due to insolvency or liquidation.

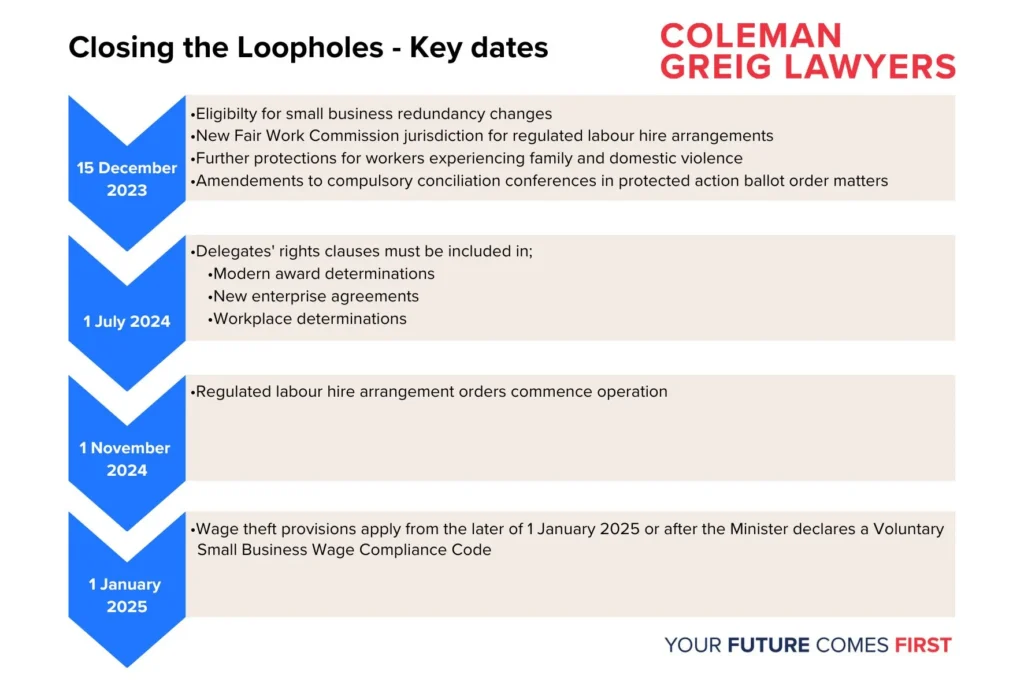

*As at 15 December 2023, on the last sitting day of parliament, the government passed the first half of its latest industrial reforms. Below is a timeline of what is changing now and the key dates:

For more information on how the key changes proposed in the Bill may impact your business and employees, please contact Coleman Greig’s Employment Law & WHS team.